Forums

FA / FL - Loan - Amortised method

Financial Reporting

Please share an illustration relating to Loan(NOT INTEREST FREE) where solution has given for both the parties I.e. lender and borrower. So that we can understand from a broader perspective that how one instrument is recognised as FA for one party and FL for another party.

Answers (9)

Not getting you sir. I am confused on the amount which needs to be recognised as FL initially. As per your illustration it’s the discontent Loan amount. As per the ICAI illustration it is the loan amount given(without discounting). I am really stuck in this. Please clarify sir

Thread Starter

Chandan SubudhiNot getting you sir. I am confused on the amount which needs to be recognised as FL initially. As per your illustration it’s the discontent Loan amount. As per the ICAI illustration it is the loan amount given(without discounting). I am really stuck in this. Please clarify sir

Sir, please ignore this. I get it clarified now.

Thread Starter

Chandan SubudhiSir, please ignore this. I get it clarified now.

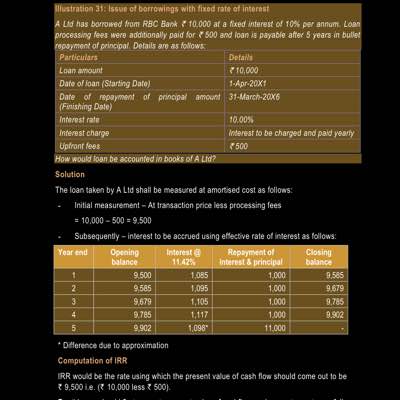

Okay. Still I have attached working at 11.42% for better clarity. Ultimately FV = Transaction price = PV

CA Suraj Lakhotia Admin

.

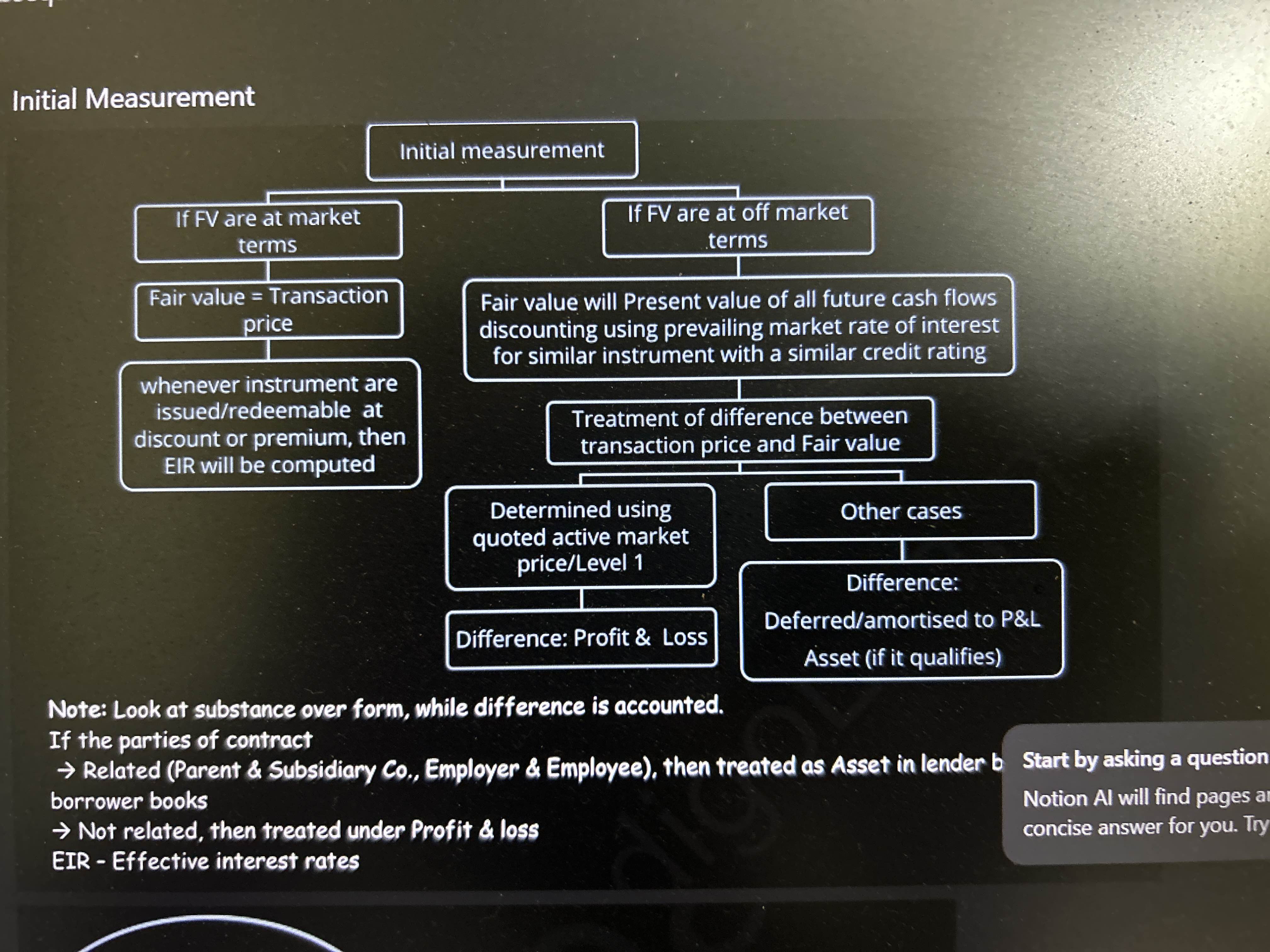

Sir, in your illustration the Fair value is not equal to transaction price then why didn’t you consider treatment as per the attached tree.