Forums

Financial statement Analysis

CFA Level I

Module 30.1 Example: Revenue recognition 1.performance Obligations

Answers (5)

Best Answer

Thread Starter

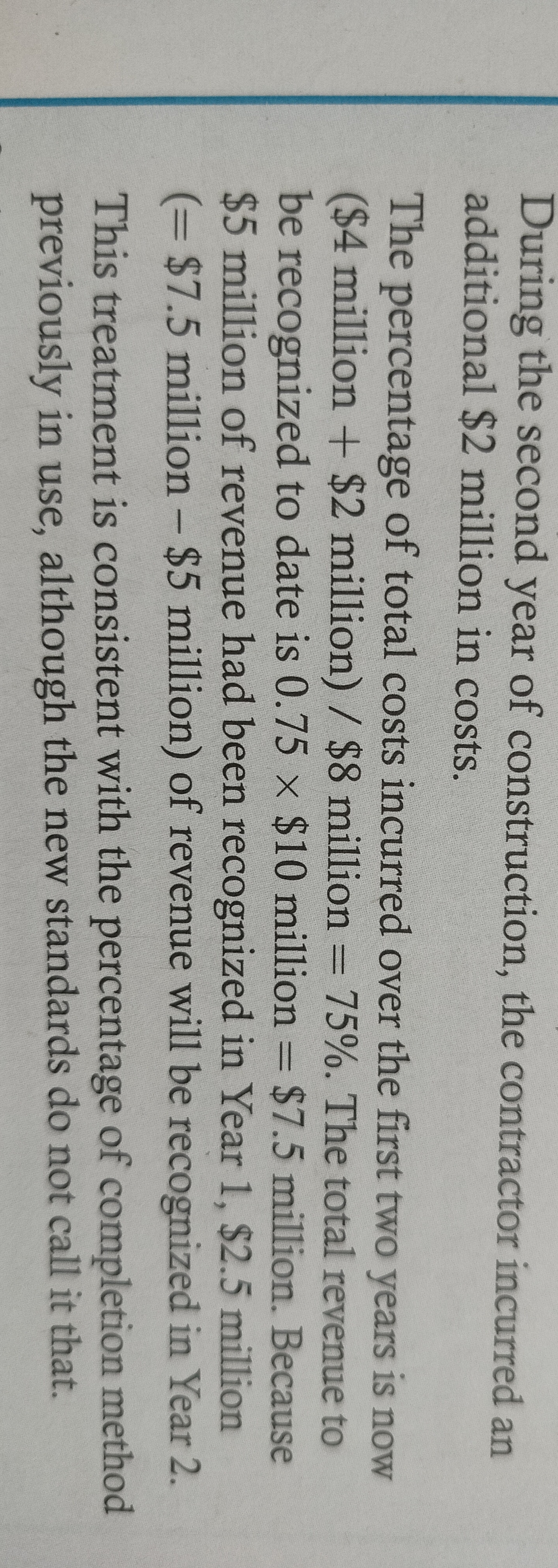

Swetha SaravananHeree, price of the warehouse 10 million and the cost 8 million sir, while the calculation of second year , why should we deduct 5 million in the end ..sir

total revenue from a project is say 10 Mio, the project is spread over 2-3 years. So cumulative revenue over 2-3 years is 10 mio So based on construction, i.e % of completion total project revenues and costs are recognized. Say project is 50% complete in yr 1 then 50% cost and revenue are recognized. In year 2 if completion rate is 75% then cumulative revenue and cost for year 2 is 75% If one has to get revenue for the year 2 then one has to subtract cumulative revenue for 2 years minus revenue recognized in year 1

Thread Starter

Swetha SaravananSir, The explanation on the example.

Pls put in a table what you understood & what you did not - we will definitely assist you