Forums

House property

Direct Taxation

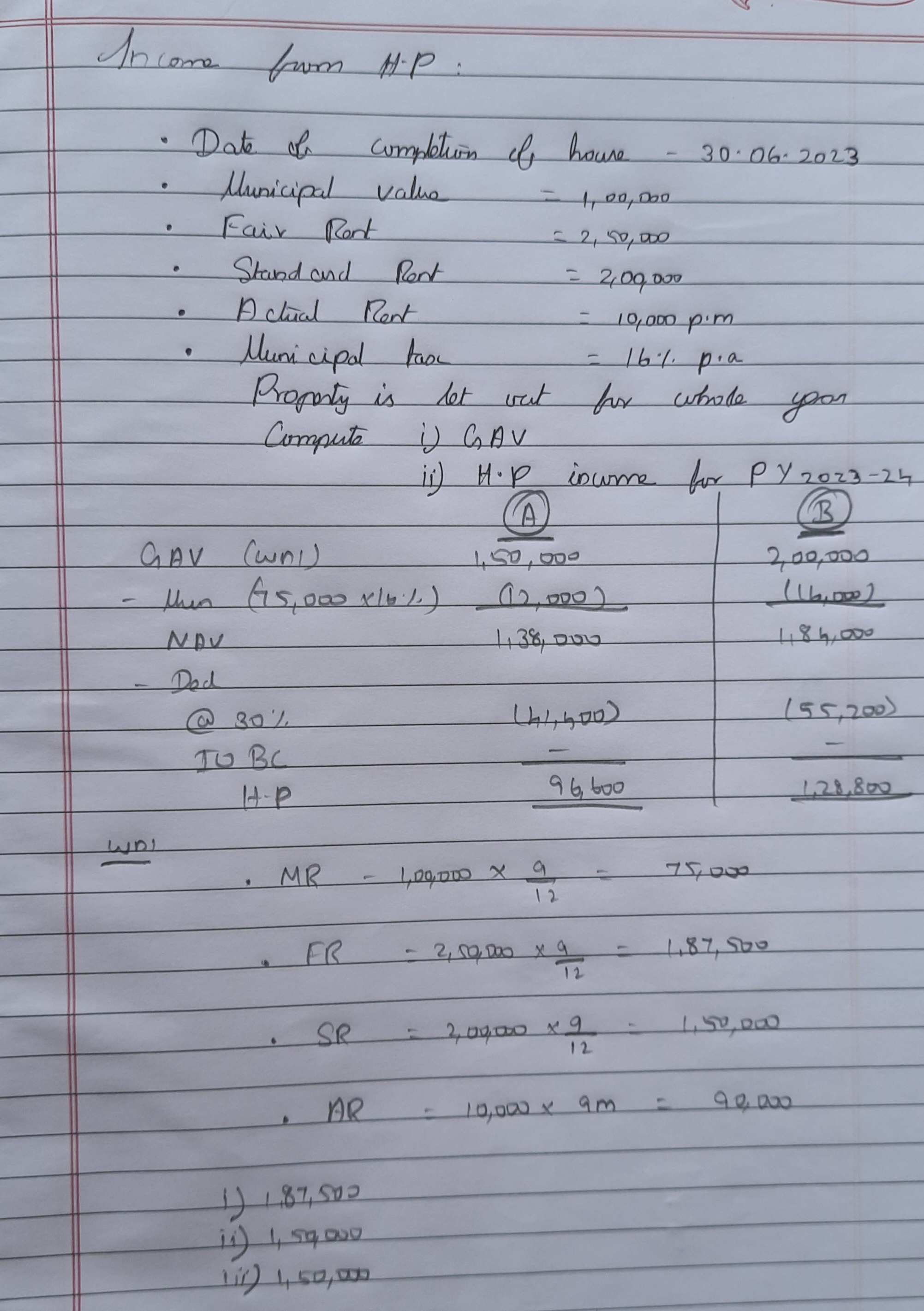

I need clarification in calculation of 1.Gross annual value 2.Municipal tax A or B which is correct???

Answers (10)

Lavi Lavanya

B is correct..if in case for municipal value, standard rent and fare rent they give per annum then only A will be correct

Municipal value,fair rent,standard rent all are in ANNUAL VALUE....

Per annum is not given..date of completion of house property is on June end So it is for 9 months the data is given also for 9 months only ..if per annum given we have to do 9/12 otherwise it is taken as the data given for the period of date of completion of house property

Lavi Lavanya

Per annum is not given..date of completion of house property is on June end So it is for 9 months the data is given also for 9 months only ..if per annum given we have to do 9/12 otherwise it is taken as the data given for the period of date of completion of house property

What if all are per annum..... What is municipal tax? 1lakh ×16% OR 75K ×16%