Forums

Interest rate is per month not per annum.

AFM

Hi sir, while computing the cost of carrying we have to multiply the spot with interest rate for 3 months. In the question they have given interest rate as 15% PER MONTH. SO the formula for cost of carrying should be [ Spot*15% per month* 3 months]. But what you have taken is [spot*15%per month*3 months/12 months]. Why we have to divide it by 12, even though they have given the interest rate PER MONTH ? Video Details Advanced Financial Management - AFM Derivatives Analysis and Valuation 26. Illustration #4

Answers (4)

Calculate the price of 3 months PQR futures, if PQR (Face Value is ₹.10) quotes ₹. 220 on NSE and the three months future price quotes at ₹. 230 and the per annum borrowing rate is given as 15 percent and the expected annual dividend is 25 percent per annum payable before expiry. Also examine arbitrage opportunities. Question says per annum borrowing rate is 15%

Sriram Somayajula Admin

Calculate the price of 3 months PQR futures, if PQR (Face Value is ₹.10) quotes ₹. 220 on NSE and the three months future price quotes at ₹. 230 and the per annum borrowing rate is given as 15 percent and the expected annual dividend is 25 percent per annum payable before expiry. Also examine arbitrage opportunities. Question says per annum borrowing rate is 15%

Also, if nothing is mentioned always take interest rates as pa. other than in money lending business with small time lenders, every where else in established financial services business banks etc all interest rates are quoted on a pa basis and not monthly basis

Sriram Somayajula Admin

Calculate the price of 3 months PQR futures, if PQR (Face Value is ₹.10) quotes ₹. 220 on NSE and the three months future price quotes at ₹. 230 and the per annum borrowing rate is given as 15 percent and the expected annual dividend is 25 percent per annum payable before expiry. Also examine arbitrage opportunities. Question says per annum borrowing rate is 15%

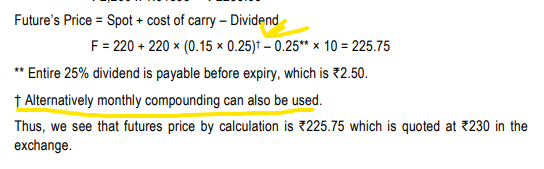

Hi Sir, in ICAI study material they mentioned it as " One Month Interest rate is 15% per annum". and while solving the question they mentioned "Monthly compounding can also be done". attached the screen shot for your reference. can you please explain how to do monthly compounding in this question. please provide the future price using monthly compounding, please provide the steps to do that as well.