Forums

Investments

Financial Management

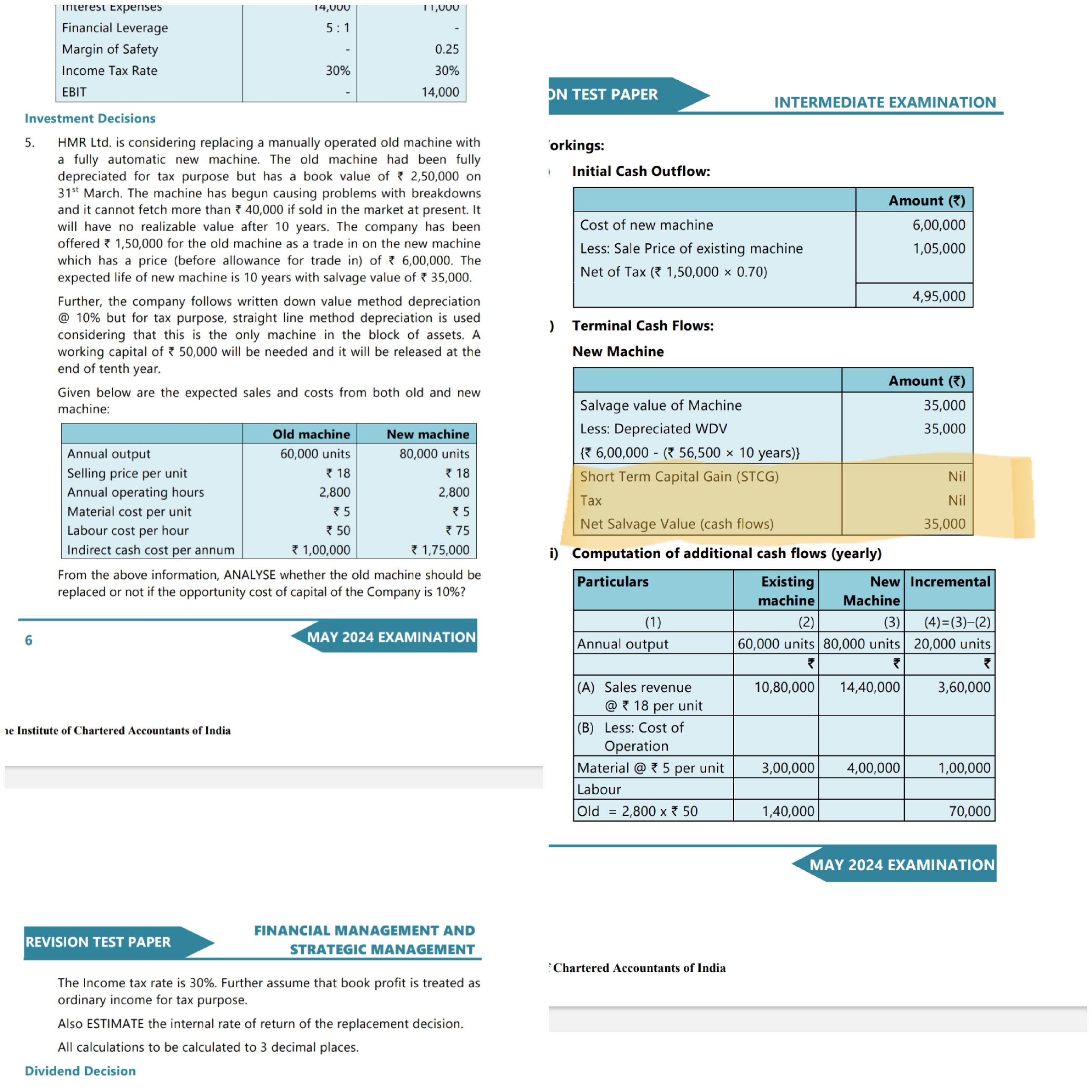

This is may 24 RTp.here in the solution stcg is nil.what should be the treatment if stcg or stcl arrises

Answers (4)

First of all, it is not a short term. Even otherwise, if loss or gain arises we will have to take the net values of gain/loss (i.e., if gain then, sale value - tax on gain & if loss, sale value + tax saving on loss) In the given problem at the time of end of life of new machine there is no data mentioned about the sale price and hence the salvage value Rs.35,000 is assumed to generate no profit/no loss. & As the existing machine would be replaced at Year 0. The incremental TCI is nothing but the Net TCI of the new machine and Hence Rs. 35,000 is discounted to PV to arrive at the PV of Inc TCI