Forums

Investments

Financial Management

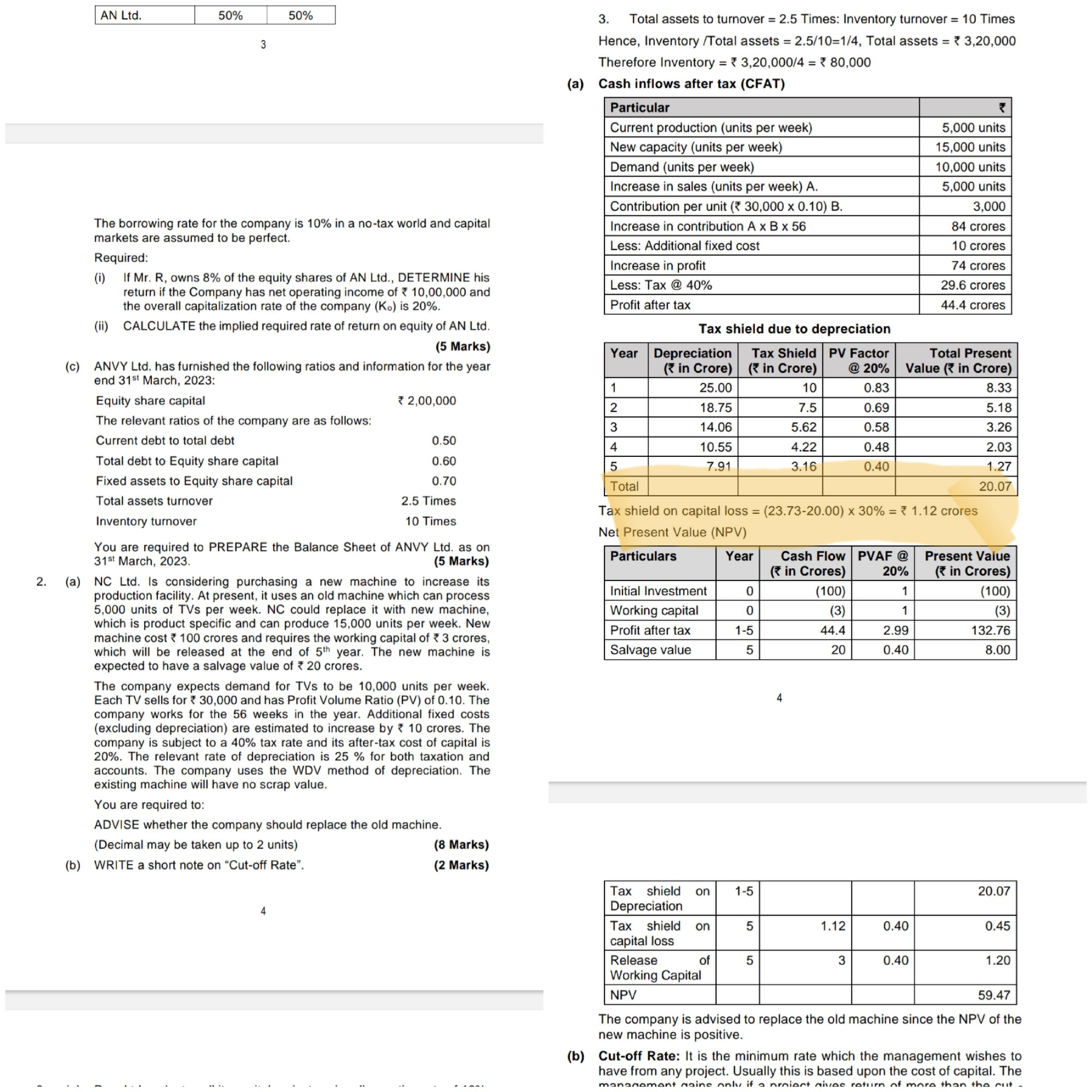

Please clarify this sir.this is mtp 1 sir .here they computed short term capital loss.but practical questions 10 and 11 of ICAI is also same model.But there they didnt compute stcg or stcl.if in question didn't mentioned anything about capital gain tax should we compute it or not

Answers (10)

In any question concerned to replacement decision, unless it is mentioned to specifically ignore, the components concerned with the capital gains tax, i.e., the resultant variation in book value and sale value, be it “tax on profit” or “tax saving on loss” shall be considered in computation of cash flows (IF & OF).

aditya yanamandra Faculty

In any question concerned to replacement decision, unless it is mentioned to specifically ignore, the components concerned with the capital gains tax, i.e., the resultant variation in book value and sale value, be it “tax on profit” or “tax saving on loss” shall be considered in computation of cash flows (IF & OF).

Okk sir thank you.if question doesn't mentioned to ignore the capital tax and if cost value of new machine is 5lakhs and sale value of existing machine is 3 lakhs and tax is 30% then should we take net initial outflow as 2,90,000 ?

aditya yanamandra Faculty

Yes, provided the existing machine is fully depreciated at the time of replacement

Sir if old machine is not depreciated fully then we should not deduct tax in initial outflow and should we compute capital loss or gains at the end?

aditya yanamandra Faculty

If not fully depreciated then tax on profit or tax saving on loss, depends upon the sale value vs book value

sir should we consider tax on old machine sale proceeds if old machine isnt fully depreciated